People seek for feedback about progress. When travelers arrive at the Chek Lap Kok International Airport, they catch a train to Kowloon and Hong Kong. In the train, there is a blue-light indicator which shows where the train is right now. This feedback gives correct information to travelers.

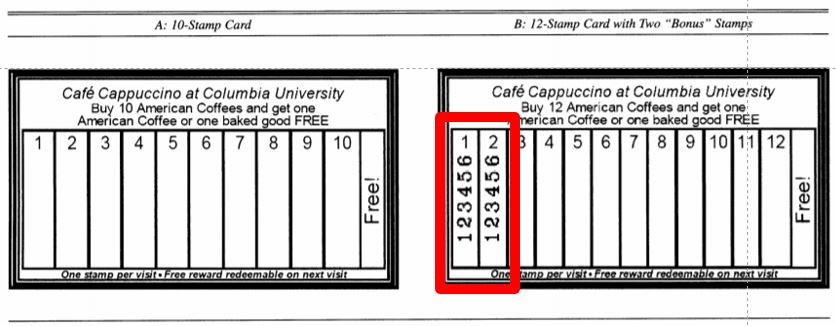

However, feedback is not always objectively given but can be subjectively manipulated. Virtual and illusory progress can be made by manipulating feedback. One of my favorite examples is the “purchase acceleration” suggested by marketing researchers. They reported that customers who received a 12-stamp coffee card with 2 preexisting “bonus” stamps (B) complete the 10 required purchases faster than customers who received a “regular” 10-stamp card (A). If the preexisting bonus stamps are presented in a more visually appealing way (like this), virtual progress could be further enhanced.

***

Reference

Kivetz, R., Urminsky, O., & Zheng, Y. (2006). The goal-gradient hypothesis resurrected: Purchase acceleration, illusionary goal progress, and customer retention. Journal of Marketing Research, 43(1), 39-58.

The goal-gradient hypothesis denotes the classic finding from behaviorism that animals expend more effort as they approach a reward. Building on this hypothesis, the authors generate new propositions for the human psychology of rewards. They test these propositions using field experiments, secondary customer data, paper-and-pencil problems, and Tobit and logit models. The key findings indicate that (1) participants in a real café reward program purchase coffee more frequently the closer they are to earning a free coffee; (2) Internet users who rate songs in return for reward certificates visit the rating Web site more often, rate more songs per visit, and persist longer in the rating effort as they approach the reward goal; (3) the illusion of progress toward the goal induces purchase acceleration (e.g., customers who receive a 12-stamp coffee card with 2 preexisting “bonus” stamps complete the 10 required purchases faster than customers who receive a “regular” 10-stamp card); and (4) a stronger tendency to accelerate toward the goal predicts greater retention and faster reengagement in the program. The conceptualization and empirical findings are captured by a parsimonious goal-distance model, in which effort investment is a function of the proportion of original distance remaining to the goal. In addition, using statistical and experimental controls, the authors rule out alternative explanations for the observed goal gradients. They discuss the theoretical significance of their findings and the managerial implications for incentive systems, promotions, and customer retention.