After arriving in California, I was struck by a coffee pod brand completely unfamiliar to me: Keurig. Despite owning a Nespresso coffee machine at the office and a De Longhi espresso machine at home, I was surprised that I had never seen or heard about Keurig before.

In California, Keurig machines are everywhere. The brand holds 41% of the single-serve coffee machine market in the United States and is estimated to have three times the sales of Nespresso nationwide.

However, Nespresso is the leading coffee capsule brand in most other markets. In Korea, it dominates the coffee machine market with a 52% share.

The biggest advantage of Keurig is that many coffee companies produce pods or capsules compatible with its machines. Brands like Starbucks, Peet’s Coffee, and Dunkin offer options for Keurig users. Additionally, Keurig machines and K-Cups are generally more affordable than Nespresso machines and capsules.

However, Nespresso has gaining market share in the United States. Since introducing the VertuoLine system, which brews full-size coffees in addition to espresso, Nespresso increased its US market share to 14.4% in 2023 up from 11% in 2022. During the same period, Keurig’s share declined from 56.2% to 53.1%. The competition between the two brands is intense and dynamic.

Does this mean cultural differences explain their dominance in different markets? Do Californians value variety and quantity, while Koreans appreciate premium experiences?

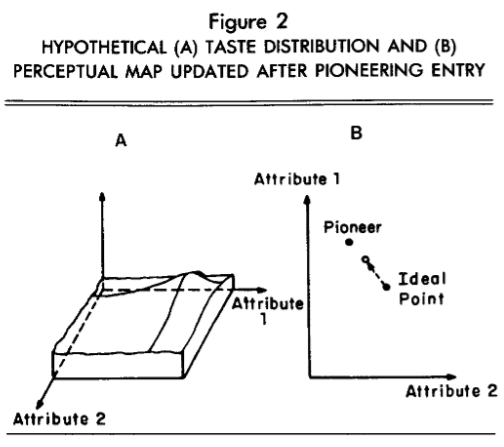

Cultural differences are unlikely to be reasons. The real explanation is much simpler: people rarely switch from the brand they first encounter. Californians often start with Keurig because it is the most accessible option, while Koreans are introduced to Nespresso through advertising. Once preferences are formed, they tend to stick.

Each brand’s popularity may not be driven by taste or luxury but by who enters the market first. This is why Uber holds an advantage over Lyft in ride-hailing services and why Waymo continues to thrive while Cruise failed in the self-driving car industry.

***

Reference

Carpenter, G. S., & Nakamoto, K. (1989). Consumer Preference Formation and Pioneering Advantage. Journal of Marketing Research, 26(3), 285-298.

Examined whether pioneering advantage could arise from the process by which consumers learn about brands and form their preferences (PFs). In 2 experiments with 103 MBA students, hypothetical emerging markets were constructed, varying the order of brand (computer software packages or down quilts) entry across Ss and the types of competitors that subsequently entered the market. Analysis showed that PFs were influenced by the order of brand entry. Moreover, the PF formation process produced a PF structure that made a pioneer’s market share largely invulnerable to competitors, even if switching costs were minimal and brands could reposition.

Thank you for this interesting article. Culture and familiarity certainly do influence the trend.

Also Americans (US citizens) generally prefer bad coffee. Most of them can’t handle the intensity of an espresso, or even a lungo (not enough water for them) . That’s why they love over-sized coffee orders over the right-sized drinks Europeans and Asians enjoy. I’m not a fan of Nespresso, but it does taste decent and is vastly superior to K-cups. I think this is also why Starbucks doesn’t advertise their coffee as much as their premises– they know their coffee is terrible. It will take a while before Americans can stomach and love proper coffee.

By the way, Keurig was bought out from the original inventor by a coffee conglomerate that used to make the K-cups but didn’t like to pay royalties.

Thank you for commenting. I agree that coffee preferences take time to build. Many Asians seem to enjoy stronger and slightly sour espresso tastes, while the US people seem to prefer a milder and larger style. Keurig may have succeeded partly because it fit US tongues so well.