Cafe Strada has long been a beloved spot among UC Berkeley students. Its prime location inside the campus, cozy patio, and inviting workspaces make it the perfect place for studying alone or meeting friends.

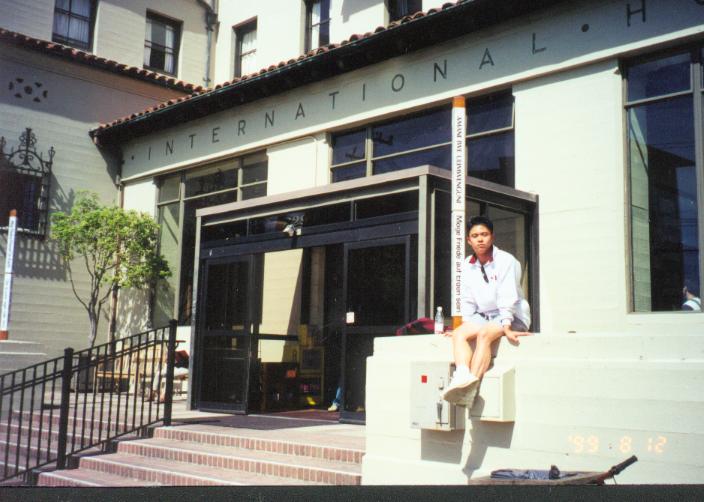

But for me, Cafe Strada is more than just a popular cafe. It is a personal place tied to a memorable period of my life. In 1999, as an exchange student living at the International House, I often stopped by this cafe in the morning. A five-minute walk there was a comforting ritual.

When I revisited 25 years (!) later, I was amazed that nothing had changed. The International House and Cafe Strada remained just as I remembered it. While everything around me seems to change, their steady presence felt like a journey back in time.

Then, I ended up buying more baked goods than I needed, but it did not matter. When I did this nostalgic consumption, as psychologists argue, my desire to save money was weakened. For me, Cafe Strada is more than just a cafe—it is where memory dominates money.

***

Reference

Lasaleta, J. D., Sedikides, C., & Vohs, K. D. (2014). Nostalgia Weakens the Desire for Money. Journal of Consumer Research, 41(3), 713–729.

Nostalgia has a strong presence in the marketing of goods and services. The current research asked whether its effectiveness is driven by its weakening of the desire for money. Six experiments demonstrated that feeling nostalgic decreased people’s desire for money. Using multiple operationalizations of desire for money, nostalgia (vs. neutral) condition participants were willing to pay more for products (experiment 1), parted with more money but not more time (experiment 2), valued money less (experiments 3 and 4), were willing to put less effort into obtaining money (experiment 5), and drew smaller coins (experiment 6). Process evidence indicated that nostalgia’s weakening of the desire for money was due to its capacity to foster social connectedness (experiments 5 and 6). Implications for price sensitivity, willingness to pay, consumer spending, and donation behavior are discussed. Nostalgia may be so commonly used in marketing because it encourages consumers to part with their money.